Filter by

SubjectRequired

LanguageRequired

The language used throughout the course, in both instruction and assessments.

Learning ProductRequired

LevelRequired

DurationRequired

SkillsRequired

SubtitlesRequired

EducatorRequired

Results for "payroll tax"

Status: Preview

Status: PreviewIndian School of Business

Skills you'll gain: Loans, Financial Planning, Finance, Wealth Management, Financial Management, Budgeting, Tax Planning, Investments, Income Tax, Risk Management, Goal Setting

Status: Preview

Status: PreviewTel Aviv University

Skills you'll gain: Social Justice, Economics, Policy, and Social Studies, Socioeconomics, Tax, Economics, Public Policies, Income Tax, Policy Analysis, Technology Strategies, Environmental Policy

Status: Free Trial

Status: Free TrialUniversity of Pennsylvania

Skills you'll gain: Financial Statements, Financial Statement Analysis, Working Capital, Financial Accounting, Financial Analysis, Balance Sheet, Accounting, Tax Planning, Inventory Accounting, Accounts Receivable, Income Tax, Tax, Equities, Cash Flows, Fixed Asset, Depreciation

Status: Free Trial

Status: Free TrialAutomatic Data Processing, Inc. (ADP)

Skills you'll gain: Payroll, Payroll Administration, Payroll Tax, Payroll Processing, Payroll Reporting, Non-Profit Accounting, Payment Processing and Collection, Specialized Accounting, Record Keeping, Accounting, Tax Compliance, Tax Laws, Law, Regulation, and Compliance, Organizational Structure, Data Analysis

Status: Preview

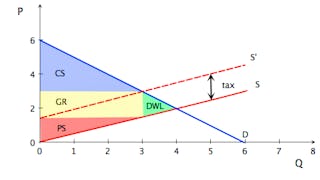

Status: PreviewUniversity of Pennsylvania

Skills you'll gain: Supply And Demand, Economics, Market Dynamics, Market Analysis, Resource Allocation, Policy Analysis, Tax, Consumer Behaviour, Decision Making

Status: Preview

Status: PreviewUniversiteit Leiden

Skills you'll gain: Corporate Tax, Tax Planning, Tax Laws, Tax, Income Tax, Tax Compliance, International Finance

Status: Free Trial

Status: Free TrialSkills you'll gain: Goal Setting, Budgeting, Tax, Financial Planning, Cash Flow Forecasting, Financial Analysis, Income Tax, Credit Risk, Finance, Expense Management, Decision Making, Investments, Self-Awareness

Status: Free Trial

Status: Free TrialRice University

Skills you'll gain: Economics, Supply And Demand, Market Dynamics, Tax, Market Analysis, International Relations, Operating Cost, Policy Analysis, Consumer Behaviour, Decision Making

Status: Free Trial

Status: Free TrialCoursera Instructor Network

Skills you'll gain: Ledgers (Accounting), Tax Planning, Auditing, Tax Compliance, Income Tax, Financial Auditing, Financial Reporting, Compliance Management, Accounting Records, Regulatory Compliance, Financial Controls, Reconciliation

Status: Free Trial

Status: Free TrialUniversity of Pennsylvania

Skills you'll gain: Operations Management, Operational Efficiency, Process Analysis, Process Management, Process Improvement, Lean Methodologies, Workflow Management, Continuous Improvement Process, Capacity Planning, Quality Management, Supply Chain Management, Statistical Process Controls, Process Flow Diagrams, Resource Utilization, Root Cause Analysis

Status: Free Trial

Status: Free TrialRutgers the State University of New Jersey

Skills you'll gain: Supply Chain Management, Strategic Decision-Making, Working Capital, Data Analysis, Operational Efficiency, Performance Measurement, Job Analysis, Financial Analysis

Skills you'll gain: Tax Compliance, Tax Laws, Compliance Reporting, Compliance Management, Regulatory Compliance, Corporate Tax, Tax, Document Management, International Finance

Searches related to payroll tax

In summary, here are 10 of our most popular payroll tax courses

- Basic Financial Literacy: Indian School of Business

- Economic Growth and Distributive Justice Part I - The Role of the State: Tel Aviv University

- More Introduction to Financial Accounting: University of Pennsylvania

- Exploring the Field of U.S. Payroll: Automatic Data Processing, Inc. (ADP)

- Microeconomics: The Power of Markets: University of Pennsylvania

- Taxation of Multinationals for Everyone: Universiteit Leiden

- Introduction to Personal Finance: SoFi

- Principles of Economics: Introduction - Getting to Know You: Rice University

- Financial Reporting: Ledgers, Taxes, Auditing Best Practices: Coursera Instructor Network

- Introduction to Operations Management: University of Pennsylvania