Filter by

SubjectRequired

LanguageRequired

The language used throughout the course, in both instruction and assessments.

Learning ProductRequired

LevelRequired

DurationRequired

SkillsRequired

SubtitlesRequired

EducatorRequired

Results for "income tax"

Status: Free Trial

Status: Free TrialIndian School of Business

Skills you'll gain: Financial Statements, Financial Statement Analysis, Balance Sheet, Securities Trading, Financial Accounting, Income Statement, Financial Analysis, Market Liquidity, Financial Market, Market Data, Market Dynamics, Technical Analysis, Market Analysis, Cash Flows, Equities, Order Management, Portfolio Management, Risk Analysis

Status: Free Trial

Status: Free TrialUniversity of Illinois Urbana-Champaign

Skills you'll gain: Supply And Demand, Economics, Business Economics, Market Dynamics, Tax, Resource Allocation, Consumer Behaviour, Price Negotiation, Cost Management, Production Management

Coursera Project Network

Skills you'll gain: Budgeting, Microsoft Excel, Budget Management, Excel Formulas, Spreadsheet Software, Accounting and Finance Software, Financial Data, Microsoft 365

Status: Preview

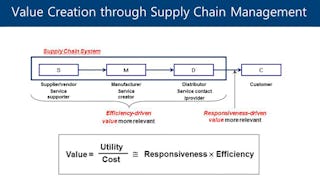

Status: PreviewKorea Advanced Institute of Science and Technology(KAIST)

Skills you'll gain: New Product Development, Supply Chain, Supply Chain Management, Supply Chain Planning, Quality Management, Operations Management, Logistics Management, Supplier Management, Transportation, Supply Chain, and Logistics, Inventory Management System, Coordinating, Corporate Sustainability, Value Propositions, Continuous Improvement Process, Consumer Behaviour, Cross-Functional Collaboration, Decision Making, Complex Problem Solving

Status: Free Trial

Status: Free TrialUniversity of California, Irvine

Skills you'll gain: Month End Closing, Financial Accounting, Financial Statements, Ledgers (Accounting), Accounting, Income Statement, Balance Sheet, Accounting Records

Status: Free Trial

Status: Free TrialRutgers the State University of New Jersey

Skills you'll gain: Demand Planning, Forecasting, Customer Demand Planning, Supply Chain Planning, Sales Management, Time Series Analysis and Forecasting, Supply Chain Management, Production Planning, Planning, Trend Analysis, Decision Making, Microsoft Excel

Status: Free Trial

Status: Free TrialUniversity of Pennsylvania

Skills you'll gain: Financial Statements, Financial Statement Analysis, Working Capital, Financial Accounting, Financial Analysis, Balance Sheet, Accounting, Tax Planning, Inventory Accounting, Accounts Receivable, Income Tax, Tax, Equities, Cash Flows, Fixed Asset, Depreciation

Status: Free Trial

Status: Free TrialSkills you'll gain: Payroll, Payroll Administration, Payroll Processing, Payroll Tax, Sales Tax, Balance Sheet, Accounting, Accounts Payable, Financial Accounting, General Accounting, Equities, Bookkeeping, General Ledger, Mortgage Loans, Loans, Tax Compliance

Status: Preview

Status: PreviewYale University

Skills you'll gain: Health Disparities, Health Systems, Public Health, Epidemiology, Infectious Diseases, Chronic Diseases, Health Policy, Environment Health And Safety, Maternal Health, Injury Prevention, Nutrition and Diet, Child Health

Status: Free Trial

Status: Free TrialIntuit

Skills you'll gain: Inventory Accounting, Inventory Control, Depreciation, Fixed Asset, Property Accounting, Financial Accounting, Asset Management, Accounting, Financial Statements, Lease Contracts, Accounting Records, Bookkeeping, Income Statement, Balance Sheet, Capital Expenditure, Operating Expense

Status: Preview

Status: PreviewÉcole Polytechnique Fédérale de Lausanne

Skills you'll gain: Waste Minimization, Environmental Engineering, Pollution Prevention, Environmental Management Systems, Environment and Resource Management, Governance, Environmental Science, Community Development, Environmental Regulations, Environmental Policy

Status: Free Trial

Status: Free TrialUniversity of Pennsylvania

Skills you'll gain: Financial Statements, Financial Modeling, Strategic Decision-Making, Decision Making, Data-Driven Decision-Making, Business Analytics, Financial Forecasting, Capital Budgeting, Financial Analysis, Return On Investment, Income Statement, Balance Sheet, Risk Analysis, Cash Flows, Spreadsheet Software

In summary, here are 10 of our most popular income tax courses

- Trading Basics: Indian School of Business

- Firm Level Economics: Consumer and Producer Behavior: University of Illinois Urbana-Champaign

- Creating a Budget with Microsoft Excel: Coursera Project Network

- Supply Chain Management: A Learning Perspective : Korea Advanced Institute of Science and Technology(KAIST)

- Completing the Accounting Cycle: University of California, Irvine

- Supply Chain Planning: Rutgers the State University of New Jersey

- More Introduction to Financial Accounting: University of Pennsylvania

- Liabilities and Equity in Accounting: Intuit

- Essentials of Global Health: Yale University

- Assets in Accounting: Intuit